A Comparison Between Cash Management Products

3/2023

By Robert Eifert, CFP®

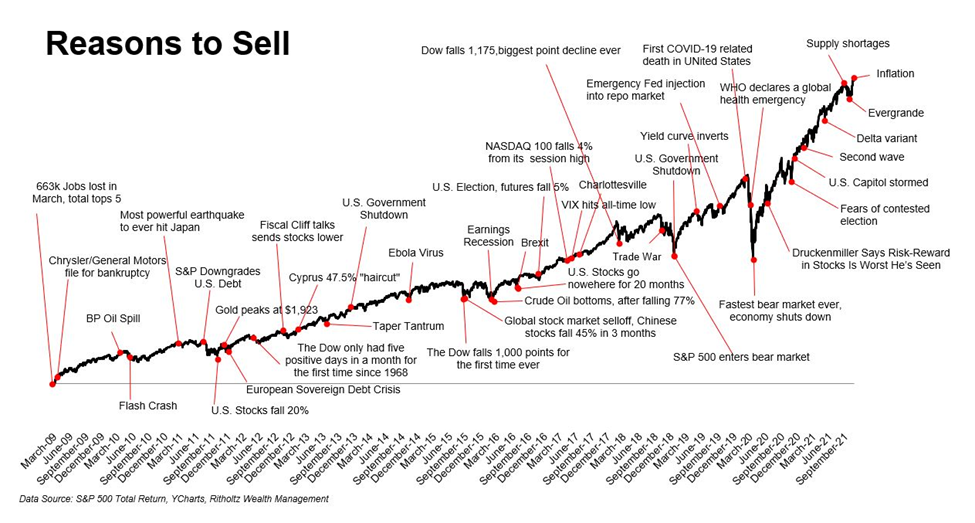

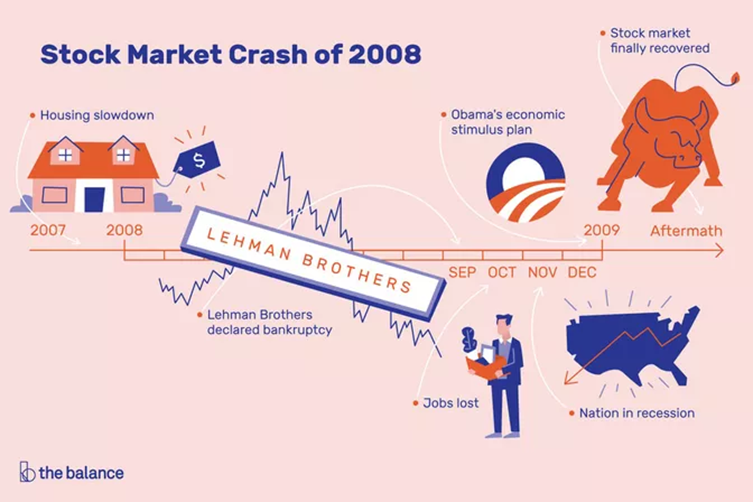

In light of recent events such as the Silicon Valley Bank collapse, many individuals have questions about cash management strategies. As the Federal Reserve has been on a campaign to raise interest rates to combat inflation, the cost to borrow has increased significantly, and the broader markets are exhibiting volatility while investors attempt to interpret what’s next for the economy. On the other side of the coin, rates in short-term cash-like instruments have begun to rise to reflect the current rate environment.

In the midst of a tortuous market cycle, the ears of many investors and financial professionals tend to perk up when they hear there are ways to earn a 3%-5%1 return while taking on very little (or, in some cases, zero) risk.

While the exact path and duration of the Fed’s current monetary policy may be uncertain, we at Cahaba Wealth avoid altering our strategy based on short term predictions or pontifications. We choose to focus on the opportunity to take advantage of these high yielding and highly liquid products when it makes sense for clients.

Every decision we make for client portfolios is based on a comprehensive financial plan and the 3 pillars of investment management:

- Risk tolerance

- Time horizon

- Cash flow needs

Below, we will compare and contrast a few methods of managing cash for clients who have excess savings. An important distinction to make is that the savings vehicles we are comparing here are only one small component of a well-diversified portfolio that is aligned with goals and risk tolerance. Depending on your unique situation, the following vehicles could be preferable to traditional checking accounts that are currently paying little to no interest 1.

High Yield Savings Accounts:

These are traditional deposit accounts at various banking institutions that compete for the highest rate and most account flexibility. There may be limitations on the amount of transfers in or out of these account in any given month, but this still affords very quick access to a linked checking account for any expenditures. As these accounts are offered by banking institutions, depositors receive full FDIC insurance (up to the limit of $250k per account holder). Because of the safety and flexibility of these accounts, rates are generally lower than other products available.

Certificate of Deposit (Brokered):

A CD is a banking product that offers a fixed rate of interest in exchange for holding a deposit with that bank for a pre-determined time period. For our purposes, we will focus on the higher yielding “brokered” CDs that banks offer to depositors through larger brokerage houses like Fidelity, Schwab, Vanguard, etc. These are still bank products and are insured up to the FDIC limit.

The rate on a brokered CD is generally higher than a savings account because purchasers are agreeing to leave their deposits with the bank for anywhere from a few months to a number of years. This can be beneficial because the rate is locked up for that period, despite any interest rate fluctuations.

A brokered CD actually has a secondary trading market where one can sell before the end of the term if funds are needed (CDs obtained directly from a bank lack this feature and charge penalties to do so). The price of these CDs is highly dependent on prevailing interest rates and a number of other factors, so there is still a risk that the purchaser could receive less than the actual value that would be achieved if held to maturity.

Treasury Bills:

A T-Bill is U.S. Government debt that matures in a period of one year or less. These securities are typically sold at a “discount to par value”. This essentially means that the purchase price is less than the stated “par value”, and upon maturity the purchaser is paid that par value. The difference between purchase price and par value represents interest earned (in order to compare with other interest-bearing instruments).

T-Bills are regarded as one of the safest assets in existence, as they are backed by the unlimited taxing authority and borrowing power of the U.S. Government.

As of late, T-bills and Brokered CDs of similar maturities have been trading rank for the highest interest rate1. However, T-bills have the advantage when it comes to liquidity. The secondary market for treasury instruments is very robust which means that they are very easy to liquidate before maturity, should the need arise.

An additional benefit of Treasury instruments is that they are generally exempt from state and local income tax. This can result in significant savings depending on one’s tax situation and the amount invested.

Money Market Mutual Funds:

These Mutual Funds consist of a mix of very safe, short term assets from the U.S. Government, banks, and high quality corporate issuers. There is a wide offering of Money Market Funds that allow investors to tailor their exposure to various instruments based on desired yield, risk and tax treatment. The rates earned with these funds are variable, but we’ve found that they can be competitive with the other instruments listed even after the fund management fees are considered.

A distinct benefit of a money market fund is the ability to liquidate all or a portion of the investment at the $1.00 “per share” value that the funds maintain. This allows investors to earn and re-invest the interest, all while preserving the ability to utilize the cash in short order.

These products each have different use cases, and are no substitute for a diversified portfolio that is aligned with investment objectives. The financial planning process is a critical piece needed in order to effectively manage a liquidity portfolio. Armed with the knowledge of our clients’ short and intermediate term liquidity needs, we can align our clients’ hard earned savings in the appropriate vehicles. If you have questions regarding your specific situation, please do not hesitate to reach out.

Robert Eifert, CFP®, is an associate advisor in the Birmingham office of Cahaba Wealth Management, www.cahabawealth.com.

1 Based on interest rate environment as of March, 2023.

Source: “Fidelity Money Market Funds.” Money Market Funds | Fidelity Institutional, Fidelity Institutional Asset Management®, 19 July 2022, https://institutional.fidelity.com

Source: Kozlowski, Julian, and Samuel Jordan-Wood. “Where Do You Keep Your Liquid Wealth-Bank Deposits or T-Bills?” Economic Research – Federal Reserve Bank of St. Louis, 16 Dec. 2022, https://research.stlouisfed.org

Source: Leondis, Alexis. “CDS versus T-Bills: For High-Yield Savings, Go with Treasuries.” Bloomberg.com, Bloomberg, https://www.bloomberg.com

Source: “Maintaining the Stable Net Asset Value Feature of Money Market Funds.” GFOA.org, Government Finance Officers Association, https://www.gfoa.org

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.