4/2022

By Brian O’Neill, CFP®

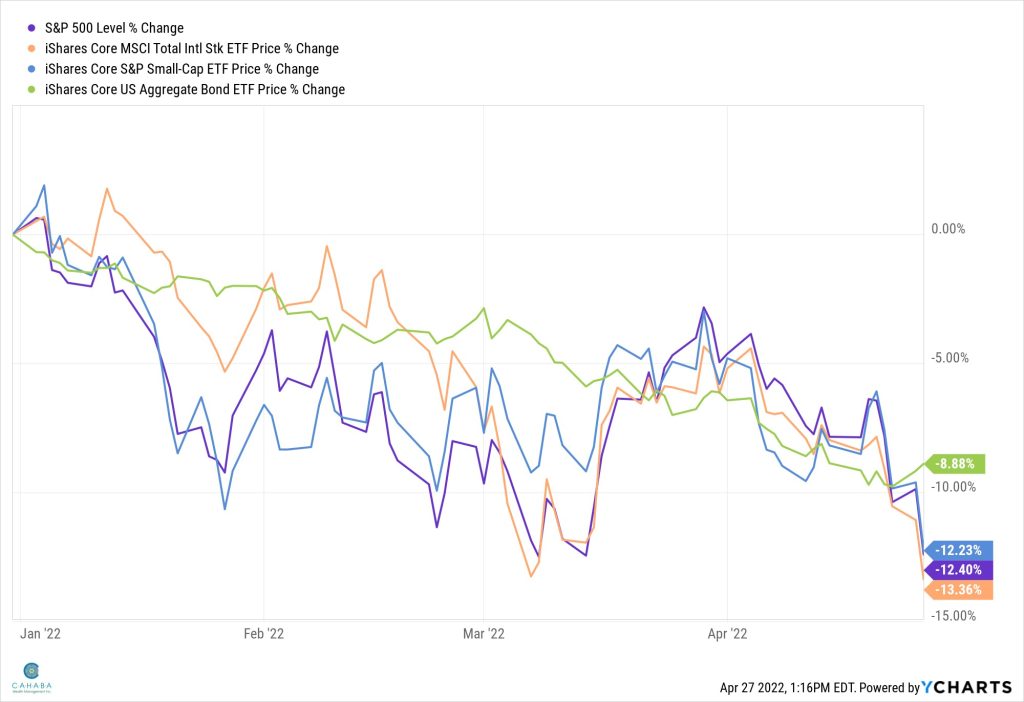

2022 has been a difficult year to be an investor. Through Tuesday, April 26th, the S&P 500 and S&P 600 (small caps) are down more than 12%, foreign stocks are down more than 13%, and bonds are down almost 9%. There has been no place to hide…

Even with this negativity, we continue to preach our consistent message of understanding your financial plan, knowing we have maintained flexibility with an intimate knowledge of client cash flow needs. That said, there are also reasons to focus on our investment approach, and remind clients why diversification still matters, even when it feels like everything is falling.

The S&P 500 is constructed of roughly the 500 largest US companies, weighted by market capitalization. We say roughly because this index does change over time, and companies can be added or deleted from the index at any given time, so 500 is a round target. Additionally, the S&P Index Committee has specific criteria that must be met for inclusion in any index, and thus not every company stock may qualify.

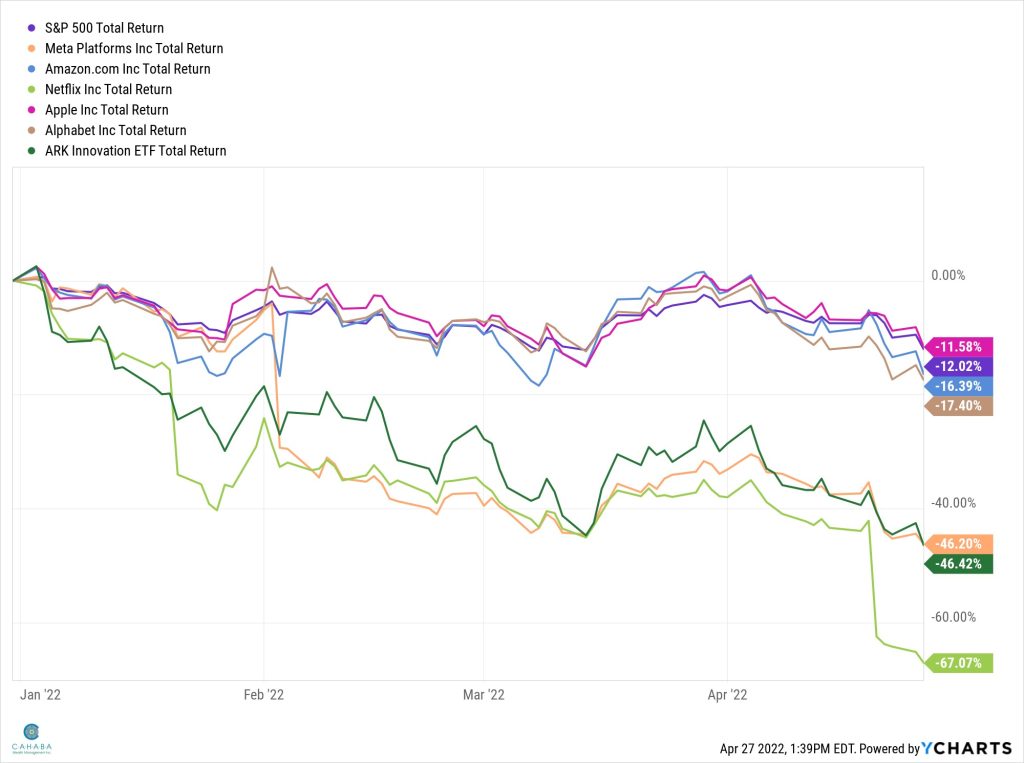

With the stocks that do qualify, 2022 performance has been anything but uniform. The best performing stock in the index so far this year has been Occidental Petroleum, up more than a whopping 90% year to date! However, the worst performing stock has been Netflix – once the darling of Wall Street, but currently down more than 67% as of this writing. In fact, many of the true high flying stocks of the post-pandemic era, and technology winners of the past decade, are performing well below the S&P 500.

This chart shows the year-to-date returns of the FAANG stocks (Facebook (now Meta), Apple, Amazon, Netflix and Google (now Alphabet)), and the ARK Innovation ETF (symbol ARKK), which has been a headline grabbing investment star over the past 36 months. All but Apple have underperformed the S&P, and most by large margins.

The point of this is a quick reminder of why we diversify. Going after the hot names can feel great when it works, but you can see the damage it can cause when it does not. Very few analysts were predicting the fall of technology stocks. In most cases, they argued strongly that there was no reason to own anything but those stocks!

Investing is hard, and much of that comes from our own emotions and biases. We constantly allow the tendency to place too much emphasis on experiences that are freshest in our memory (Recency Bias) to dictate our investing decisions. Fear of Missing Out is a powerful concept, but it’s times like these that we can know that sometimes, missing out is ok.

Brian O’Neill, CFP®, is president and a financial advisor in the Atlanta office of Cahaba Wealth Management, www.cahabawealth.com.

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.