6/2024

By Crawford Asman

While we acknowledge the imperfections of surveys and how they are used, a recent Harris Poll taken exclusively for the Guardian revealed wide-spread pessimism regarding the economy. The results caught our attention not for the accuracy of the results but for how it demonstrates the power of a concentrated narrative on public opinion. The results showed that nearly 3/5 Americans believe the US is in the midst of an economic recession. The poll emphasized many misnomers about the economy, with the most notable being:

- 49% believe that unemployment is sitting at a 50-year high, however, the current rate has been below 4% since February of 2022.

- 49% believe that the S&P 500 is down for the year, though the index saw a 26% total return in 2023 and nearly 12% YTD.

- 55% believe the economy is shrinking and 56% believe the US is in the midst of a recession – we’ve now had 6 consecutive quarters of GDP growth.

Clearly, financial journalism has a role in creating this sentiment; after all, it’s difficult to think the economy is doing well while being bombarded by click-bait titles citing whatever global issue as the cause for the down markets that day. These headlines are meant to draw you in with borderline “fear-mongering” tactics, and it can lead to a great deal of confusion to the individual investor. However, the real “issue” here is not the election, nor is it the media. Rather, it’s us simply being human.

Humans are inherently very emotional, and there is especially no exception to that rule when it comes to the broader economy and markets. It’s normal to feel uncertain. That’s why, at Cahaba, it’s our job to provide our clients with a personalized financial plan that will give them a sense of security that they can accomplish their long-term goals. We don’t focus on the “apocalypse du jour”. Rather, we focus on the plan we originally agreed to, and stand by it. While it may not seem logical at first, long-term investors are more successful when they stick to their investment plan. In both bull and bear markets, the key is staying the course.

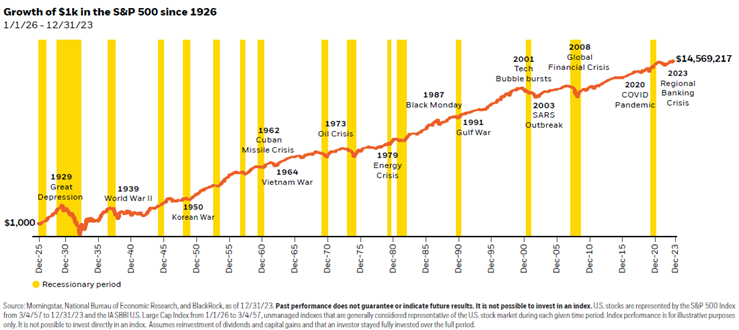

The chart above showcases the total return (including dividend reinvestment) of a $1,000 initial investment into the S&P 500 in 1926. You’ll notice that despite the countless recessionary periods and global crises, simply sticking to the long-term plan and allowing the investment to compound is incredibly powerful.

At this point, you may be asking yourself why you need an advisor in the first place if “staying the course” is all it takes to be successful. Well, the true benefit of an advisor is not how good they are at timing the market or their supposed “superior” abilities to pick undervalued stocks. It’s the guardrails they enact to prevent their clients from engaging in poor decisions that can significantly alter their financial futures.

We at Cahaba, like most people, are not capable of knowing what will happen later this year in the markets, or even later today! What we do know, however, is how to control the controllables. In essence, no matter what is going on in the world, it will not dictate your financial plan – your plan’s objectives and goals will always be the focus. I’ll conclude with one final thought from the well-respected behavioral finance expert, Daniel Crosby:

“Maybe we as a human race aren’t very well suited to help ourselves and listen to our own best advice. But we do seem equipped to help each other when times get tough – and that’s worth a whole lot.”

Sources:

- https://www.theguardian.com/us-news/article/2024/may/22/poll-economy-recession-biden#:~:text=Nearly%20three%20in%20five%20Americans,as%20election%20day%20draws%20closer.

- https://www.nickmurraynewsletters.com/members/login.cfm?hpage=June%2D2024%2Ecfm&loggedout=y

- https://www.linkedin.com/pulse/you-need-financial-advisor-reason-think-daniel-crosby-ph-d-/

Crawford Asman is a Financial Planning Analyst in the Atlanta office of Cahaba Wealth Management, www.cahabawealth.com.

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.