How We Work

A Life-Centered Approach to Building Wealth

At Cahaba Wealth Management, we understand that true wealth is rarely built overnight. For most individuals and families, it’s the result of consistent effort, sound decision-making, and long-term planning. Our goal is to be your partner in that journey – helping you make informed financial decisions today that position you for lasting success tomorrow.

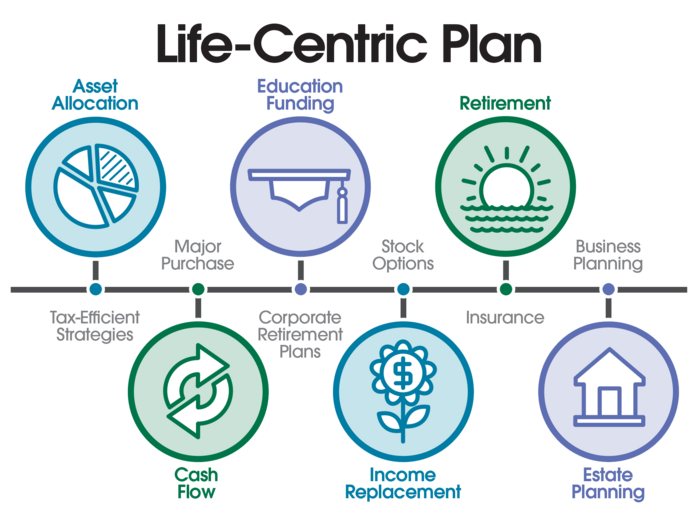

We believe that financial planning isn’t a one-time event – it’s an ongoing process. And that process begins not with numbers, but with you. We start by having meaningful conversations about what really matters to you – your family, your values, your goals, and your vision for the future. Rather than immediately focusing on your assets, we focus on your life. This life-centric approach allows us to build a holistic, personalized plan that integrates every piece of your financial world: your career, your business, your responsibilities, and your long-term goals.

Our approach is not only strategic – it’s personal.

Our Process

Discovery & Data Gathering

Our process always starts with understanding you. We take the time to get to know you and your family, your financial goals, and your lifestyle priorities. Through thoughtful conversations, we gather key information about your objectives, risk tolerance, timeline, and any financial concerns you may have. We utilize intuitive, personalized planning to bring clarity to your financial picture and create a detailed roadmap that aligns with your long-term goals. This initial stage lays the foundation for every decision we make together.

Personalized, Life-Centric Planning

Next, your dedicated Cahaba team collaborates to build your written financial plan. This plan outlines your current financial situation, identifies key areas of opportunity or concern, and provides clear recommendations tailored to your goals. You’ll receive a comprehensive plan summary and a checklist of actionable items to move forward. Our recommendations are not cookie-cutter – they’re designed to address the unique aspects of your life, and they evolve as your circumstances change.

Portfolio Construction & Investment Management

Once your financial plan is in place, we design an investment portfolio tailored to your personal goals and risk profile. Every portfolio we build is informed by our clients’ broader financial plans, ensuring your investments are aligned with both your short-term needs and your long-term goals. We focus on constructing portfolios that aim to deliver strong, risk-adjusted returns while remaining flexible enough to adapt to market conditions and life changes. Asset allocation decisions and investment selections are made with the intention of supporting your overall financial strategy – not just chasing returns.

Ongoing Monitoring & Collaboration

Your financial plan is not a static document – it’s a living, breathing strategy that we monitor and update as life unfolds. We schedule regular reviews to assess progress, make adjustments, and stay ahead of any potential issues or changes in your goals. We also help you implement every element of your plan. From coordinating with your CPA and estate attorney to managing time-sensitive financial tasks, we act as your financial facilitator – keeping your entire advisory team aligned and your plan on track. Our commitment is to remain proactive, responsive, and fully engaged in your financial journey – year after year.

Experience a smarter, more personal approach to wealth management – one that puts your life at the center of every decision.