By Henry Wideman, CFP®

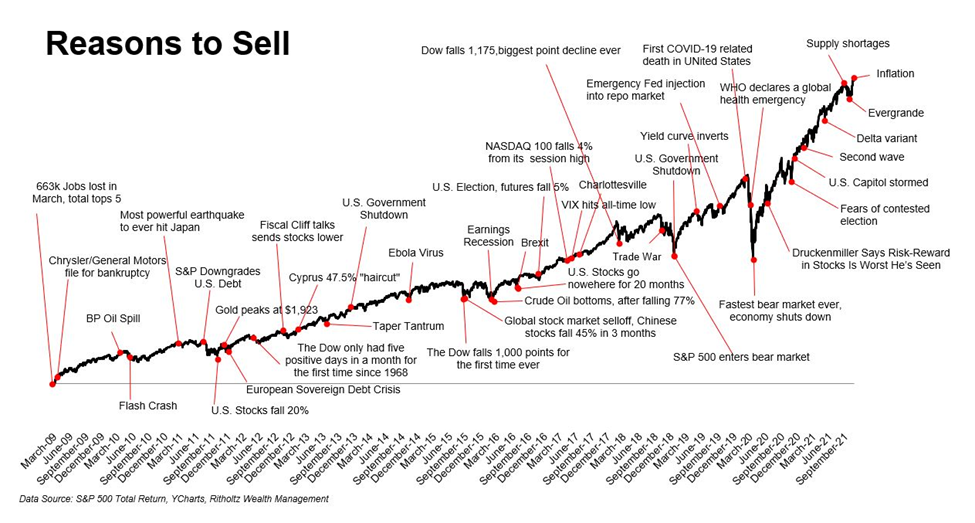

Long term investors invest in the market initially based on the indisputable fact that it has increased over time. Historically, while we know that the stock market gives us the best opportunity to outpace inflation, stocks do not increase in a linear fashion. The market will periodically give back due to recessions, valuations and unforeseen shocks.

Bull or Bear: What is Your Financial Advisors Role?

Our role as advisors is to minimize panic during periods of downturn, turning to our cash flow analysis to remind clients why they can hold on. It is not that investors forget that short term economic and market cycles occur, but humans do tend to forget how we felt when the last one began.

It is human nature to eliminate short term pain from our memory banks.

Even the most placid investor can make emotional decisions during market volatility produced by the ebbs and flows of the market cycles. A contributing factor to the investor panic is what seems to be an hourly “breaking news” story. News typically does not sell unless it is negative fear mongering. This is reaching a fever pitch given the information age in which we currently find ourselves. Even with periods of decline and bad news, long term returns remain positive.

What Does Market Volatility Mean to You?

Our most important job as financial advisors is to put our clients in the best position possible to not outlive their assets. We never want our clients to fear living beyond their means. Our team has navigated clients through three major economic recessions and market downturns in our history.

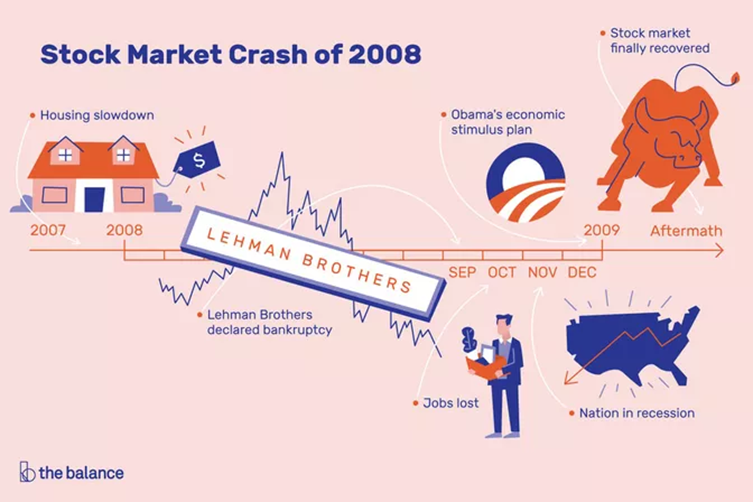

There were similarities across each of these dark periods of market volatility. First, the root cause of each crisis was distinctly different: the technology/internet bubble that burst in the early 2000s, the real estate crash and gridlock of our financial systems in 2008/2009, and the 2020 COVID-19 economic shutdown was the first pandemic since the 1917 Spanish Flu. Second, although the respective catalysts of these periods were unique, the results were basically the same. The stock market and the economy declined substantially, but eventually rebounded.

The final, and most important similarity is that the only investors who truly lost during these periods were those who panicked and sold.

The Counterintuitive Nature of Successful Investing

In order to benefit from investing in the market over time, it is vital to believe that stocks will increase, even though they will also suffer periods of volatility and decline. Investors must be in the market on its best days, as opposed to trying to miss its worst days.

Since we do not know when the best days of the market will occur, we have to unfortunately remain invested on its worst days, and use the volatility to rebalance. Evaluating your true time horizon through constant revisions to long term cash flow models will dramatically increase the odds of never having to sell temporarily depleted portfolio assets for a need. Having an advisor that keeps emotions in check during the dark days is equally important.

Navigating Inevitable Market Cycles

Yes, the current bull market will end at some point. However, through proper planning and a belief that the market will continue to provide long term returns, it simply does not matter.

There is a better way to navigate through inevitable market cycles. If you would like to learn more, contact Cahaba Wealth Management.

Henry Wideman, CFP®, is a partner and financial advisor in the Birmingham office of Cahaba Wealth Management, www.cahabawealth.com.

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.