By C.J. Laws

Whether used for capital preservation, growth, or as an additional source of income, investments are always made in hopes of seeing an increase over the long term. The appreciation of assets can eventually be capitalized on by selling. This can generate a tax liability referred to as capital gains tax.

Capital gains are created when an asset is sold at a price higher than its initial purchase price, or cost basis. Depending on the holding period of the investment, these capital gains can be long-term or short-term. A gain is considered long-term if the asset is sold after being held for more than a year, and a gain is deemed short-term if the asset is sold in less than a year from its original purchase date. Generally speaking, long-term capital gains are taxed much more favorably than short-term gains, so it’s important to understand the holding period before disposing of an asset.

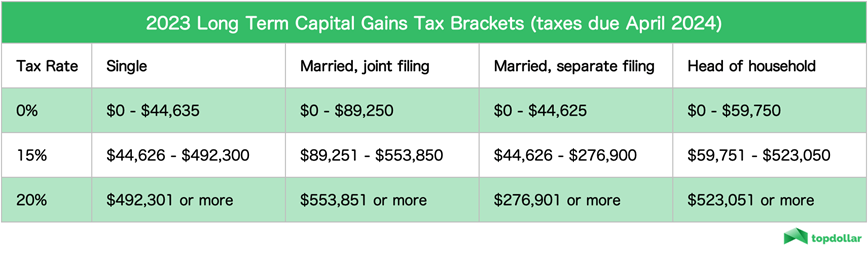

Long-term gains are federally taxed at percentages of 0%, 15%, or 20% depending on the investor’s taxable income for the year:

Based on the above table, for example, a couple that is MFJ (married filing jointly) can have a capital gains tax rate of 0% if their taxable income falls below $89,250 for the year.

Short-term capital gains, on the other hand, are taxed at the investor’s ordinary income tax rate, which can range anywhere from 10-37%.

Note that capital gains may also be taxed at the state level. Many states (such as Alabama and Georgia) tax capital gains as income. Some states allow taxpayers to deduct a certain amount of capital gains. Others don’t tax income, or capital gains at all. Taxpayers should always review the specific capital gains rules in their state.

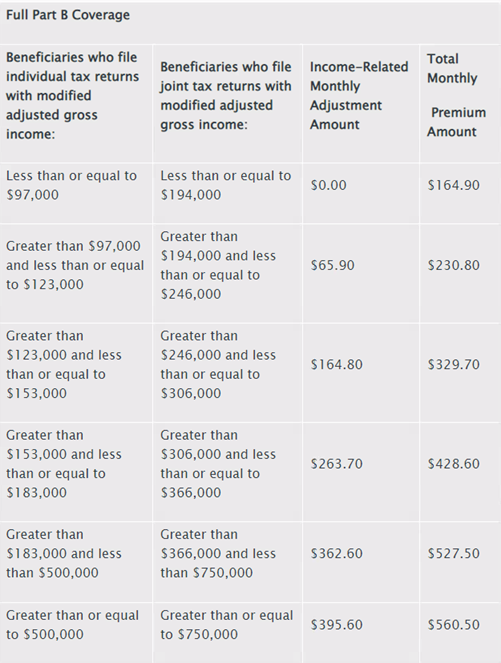

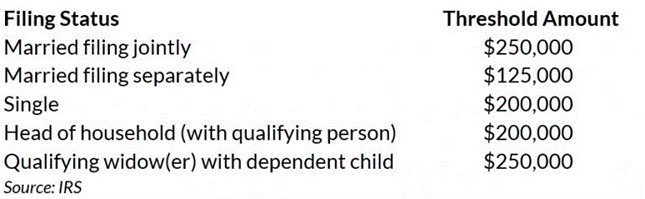

High income earners must also pay an additional net investment income tax (NIIT) on investment earnings. This additional tax is owed if one has investment income AND has MAGI (Modified Adjusted Gross Income) above a certain threshold. These thresholds are as follows:

If one has investment income and exceeds the MAGI threshold listed above, the 3.8% tax applies to the lesser of (a) their net investment income, or (b) the portion of their MAGI over the threshold.

Example 1: Assume a single filer has earned net investment income of $25,000 from dividends and interest, and she has a modified adjusted gross income (MAGI) of $260,000. Her MAGI falls above the single filing threshold of $200,000, so she will be subject to the net investment income tax. Since $25,000 (her net investment income) is less than $60,000 (the portion of her MAGI over the threshold), she will owe 3.8% tax on $25,000.

As the market fluctuates year to year, not every long-term investment will generate a capital gain; some may even have unrealized capital losses. Fortunately, these losses can be used to offset any capital gains generated in your account. After this, additional capital losses can then be used to reduce taxable income. Single individuals and couples married filing jointly (MFJ) can deduct up to $3,000 in realized losses from ordinary income, and couples married filing separately (MFS) can deduct up to $1,500 from ordinary income. If your total losses exceed your total gains in a given tax year, up to $3,000 (or $1,500 based on filing status) of this excess amount can be applied to your ordinary income. The remaining surplus can be carried over into future years, but can only be utilized in increments of $3,000 or $1,500 each year when no gains have been realized. This is defined as a tax loss carryforward. Below is a demonstration of how to use this carryforward to your advantage:

Example 2: In a given tax year, a married couple realizes a long-term capital gain of $20,000 by selling Security X, and a short-term capital gain of $5,000 by selling Security Y. They also incur a short term capital loss of $40,000 selling Security Z. They can offset 100% of their total capital gains by utilizing $25,000 of their capital loss, which brings their gain liability down to $0 for the current tax year. Now, they can use an additional $3,000 in capital losses to reduce their ordinary income. The remaining $12,000 can be used as a carryforward loss in future tax years as needed.

Understanding how to utilize your capital gains/losses against your taxable income can help with strategic tax planning by knowing which investment accounts to withdraw from on a tax efficient basis.

Here at Cahaba, our holistic approach allows us to be aware of your cash needs and develop an appropriate investment strategy that will minimize capital gains. Your financial plan is always the driving force behind any tax recommendations. There is a better way!

C.J. Laws is a financial planning analyst in the Nashville office of Cahaba Wealth Management, www.cahabawealth.com.

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.

1 Source: https://topdollarinvestor.com/federal-income-tax-brackets/