5/2023

By Charlotte Disley

The world of Medicare can often times bring on feelings of confusion, and not to mention, high premiums! It is important that those enrolling in Medicare Part B (Medical Insurance) and Part D (Drug Coverage) have a solid understanding of how their premiums are being calculated.

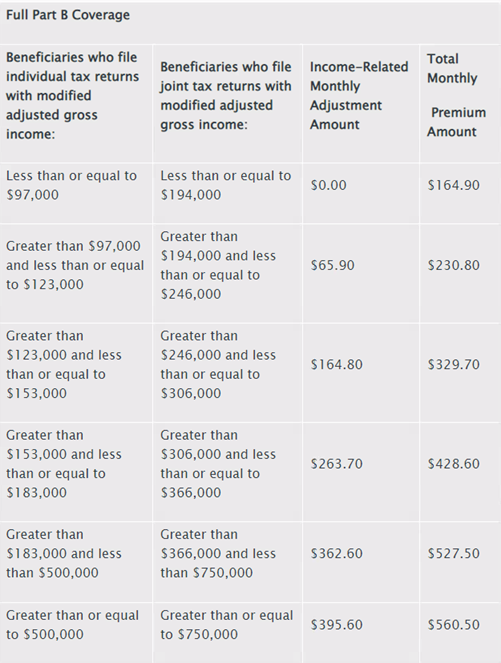

Income-Related Monthly Adjustment Amount (“IRMAA”) is a surcharge added on top of original Part B and Part D premiums, and is based on different income thresholds which are determined by Modified Adjustment Gross Income (MAGI) from two years prior. For example, premiums in 2023 would be assessed by MAGI taken from a 2021 tax return. 2023 IRMAA premiums for Part B is shown in the tables below. Note that the monthly premium amounts listed are per person.

Certain individuals may be eligible to appeal IRMAA if they have experienced a life changing event that reduced household income and moved them into a threshold with a lower premium. If income is significantly different in the current year than two years prior, then there are a few steps to take to appeal the premium amount. The SSA will not automatically adjust your premium amount, so it is important to pay attention to your income each year and ensure you are placed into the accurate IRMAA bracket.

Let’s take a look at a hypothetical, yet realistic, example of how this might play out for a couple on Medicare in 2023 looking solely at their Part B premiums.

John and Jane Doe are both age 70 and are married filing jointly. Jane retired at age 50 from company X, but her only source of retirement income is in the form of an IRA. John spent his life working at company Y where they offered a 401(k), a qualified pension (monthly annuity payment), and a non-qualified pension paid in annual installments over a 10 year-period. John retired at the end of the year in which he turned 58. They are not yet at the age of needing to take RMDs from their retirement accounts. John had been consulting since his retirement, bringing in annual earnings of $200k, but stopped at the end of 2021. On top of this, his last non-qualified pension payment of $150k paid at the end of 2021. As a couple, they have consistent streams of taxable income in the form of his qualified pension ($75k/year) and the taxable portion of their social security payments ($80k/year).

Given this information and assuming they have no other taxable income streams, in 2021, John and Jane had a MAGI of $505k. Looking back at the premium threshold, this would set them comfortably into the bracket with a $527.50 monthly premium each for 2023. Comparatively, today (assuming no additional income other than qualified pension and social security), the reality of their MAGI is $155k. This places the Doe’s into the lowest IRMAA bracket with a monthly premium of $164.90 each. This produces a whopping ~$8,700 of savings on Medicare Part B premiums if they take the time and effort to appeal IRMAA.

So, how do you actually appeal IRMAA?

You will need to fill out the following form (https://www.ssa.gov/forms/ssa-44.pdf) and provide supporting documents that show a more accurate depiction of current income. This is where Cahaba comes in to assist our clients with the process! Knowing our clients’ financial situations inside and out allows us to help prepare supporting documents, as well as cover letters detailing the request for adjustment. This takes much of the burden for preparation off of our clients, and usually results in a successful appeal!

Charlotte Disley is a financial planning analyst in the Atlanta office of Cahaba Wealth Management, www.cahabawealth.com.

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.