12/2023

In a world often marked by challenges and uncertainties, one constant source of hope and positive change is the spirit of giving. As our core values state, “Giving back matters. We invest in the communities where we live”. Cahaba Wealth Management team members are proud to have supported various charitable organizations throughout 2023, including the following:

Agape Community Center

American Cancer Society

Atlanta Community Food Bank*

Campus Crusade for Christ

CASA of Jefferson County*

Charleston Pro Bono Legal Services, Inc.

Community Food Bank of Central Alabama*

Crestline Community PTO Playground

First Harvest Food Bank of Middle TN

Friends of Warner Parks*

Gigi’s Playhouse

Hope Heals Camp

King’s Home

Mission to the World

Mountain Brook Community Church

Piedmont Park Conservatory*

Pray4Gray Foundation

Preston Taylor Ministries

Room In The Inn*

Soccer in the Streets

Truly Living Well Center*

Young Life

*indicates organizations that our offices have volunteered with as a team

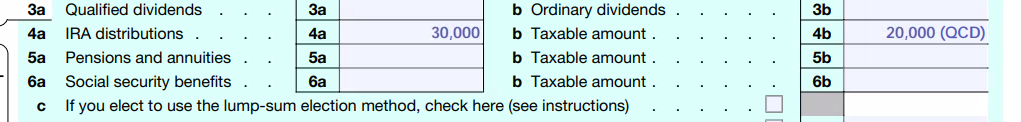

We would also like to applaud the generosity of our clients in 2023. This year, we have sent out more than 365 separate Qualified Charitable Distributions from client IRAs, representing gifts nearing $1.1M. We have also assisted clients with donating close to $4.9M worth of highly appreciated securities into Charitable Donor Advised Funds. This is in addition to any personal charitable donations our clients make.

Charitable giving stands as a testament to the inherent goodness within humanity. We are proud to work with so many generous team members and clients.

We wish you and your families a safe and happy holiday as we continue to serve!

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.