3/2023

If you processed any Qualified Charitable Distributions (QCDs) from an IRA distribution, your tax preparer will need to be aware of the total amount of QCDs. They will need to reduce the taxable amount of the IRA distribution (line 4b on Form 1040) by the QCD total.

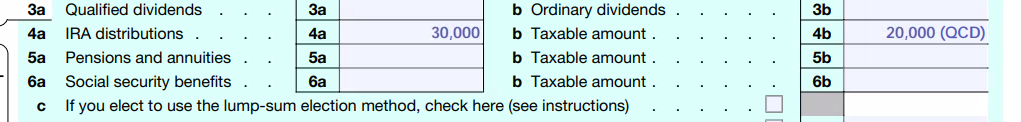

In the example below, the total IRA distribution amount was $30,000 and $10,000 worth of QCDs were processed. The taxable amount of the IRA is reduced by the QCD total.

Keep in mind that there is not a form that reports QCD amounts. Your Form 1099 will simply show the full amount that was withdrawn from your IRA. It does NOT subtract the QCD total. You are responsible for notifying your tax preparer of the amount of QCDs processed from your IRA. If you need help confirming this amount, please reach out to our team.

Note that QCDs are not to be listed on Schedule A/Itemized deductions under the “Gifts to Charity” section.

In 2022, we helped our clients process over $1 million in Qualified Charitable Distributions – let’s make sure they are getting counted properly!