2/2022

By Brian O’Neill, CFP®

Today was not a great day to turn on the news. Stocks (as measured by the S&P 500 from the all time high price reached in early January) have officially entered correction territory, in no small part due to the Russian invasion of Ukraine we all saw unfold this morning.

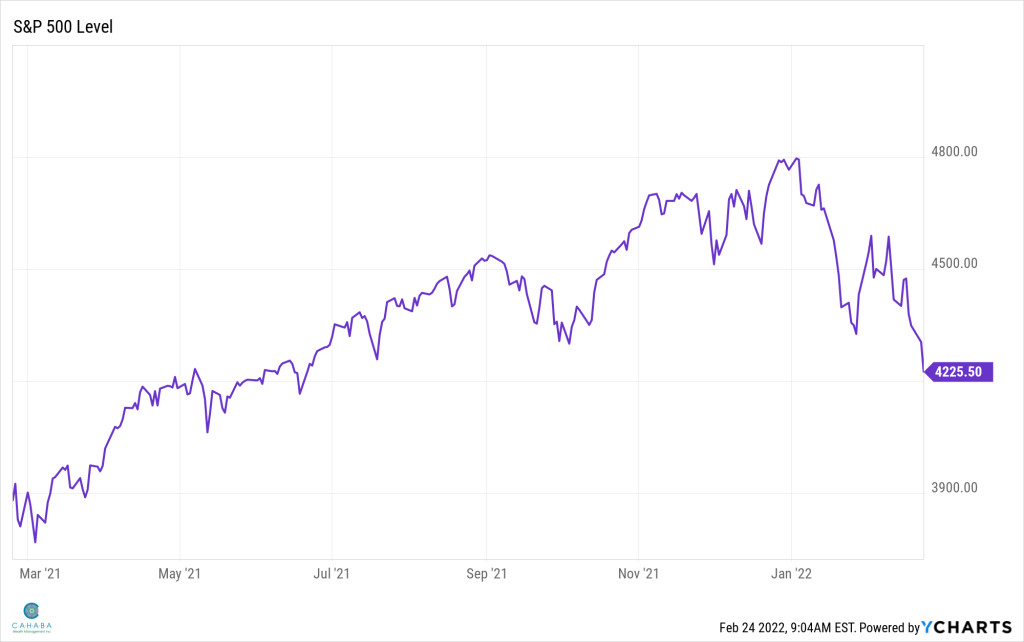

The chart above reflects the price movement of the S&P 500 over the past year, and you can see the damage that has occurred since the start of 2022. We certainly do not want to discount the fear and emotions that come with geopolitical instability and market turmoil. We do, however, believe that in these times it is worth exploring how we make decisions.

If you look at the chart above, the recent drawdown is apparent. What is less apparent is that while we are in a correction today from all-time highs, we are at the same price level on the S&P 500 we were in June 2021 – barely 8 months ago. Think back to what you were doing in June 2021, and I would strongly suggest worrying about the markets was not on your to do list. The human brain has been trained over thousands of years to deal with problems and conflict, and we are constantly constructing narratives to help us wade through these challenges. Investing is no different.

One of the most important concepts to wrestle with as an investor is Loss Aversion – this is the tendency of investors to be so fearful of losses, that they focus on that more than making gains. Let’s not forget that stocks have historically gone up three out of every four years in general. The knee jerk reaction to recent events may be to “go to cash” or to “wait this out on the sidelines,” but history tells us the markets are way smarter than any individual. By the time we realize this bout of volatility is over, it may be too late to jump back in.

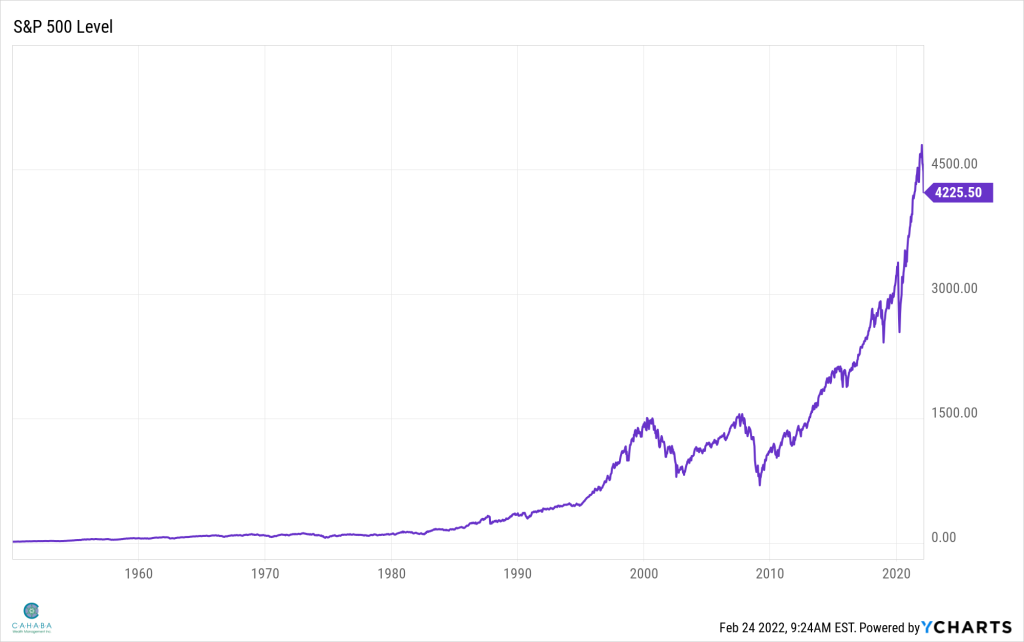

The chart above is the S&P 500 price level since 1950. While you can certainly see the various drops (specifically the 01–02 dot com bubble bust and the 08-09 financial crisis), the long-term returns are significant for those who can wait that out. Our portfolios are designed with flexibility, and when married with our understanding of each client’s unique time horizon and need from assets, we can avoid selling during these periods of negativity.

We send this primarily as an acknowledgement that these last few weeks have not been pleasant for investors. We are thankful for the opportunity to serve you as a client and look forward to continuing to be a resource for you and your family. Please let us know if you have questions or would like to discuss in greater detail.

Brian O’Neill, CFP®, is president and a financial advisor in the Atlanta office of Cahaba Wealth Management, www.cahabawealth.com.

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.