By Brian O’Neill, CFP®

Happy New Year! The beginning of 2022 has seen some extraordinary activity in the bond market, with the benchmark 10-Year Treasury yield moving from the December 31, 2021 close of 1.51%, to north of 1.8% briefly in mid-day trade on January 10, 2022.

The overall numbers don’t tend to raise eyebrows, as the nominal rate of 1.8% is still very low in historical context. However, a move of almost 20% in that yield in only seven trading days is quite unusual. Moves like this generally create headlines for the 24/7 media cycle, and thus, can also create anxiety for clients. We thought we’d add some context.

Client Portfolios and Bonds

We will continue to allocate part of client portfolios to bonds, dependent on each individual client’s tolerance for risk. With rates this low, we have continued to hear the screaming that, with higher rates, bond portfolios will somehow “destroy” value. To show why we disagree with this sentiment, let’s first look back at the past 18 months.

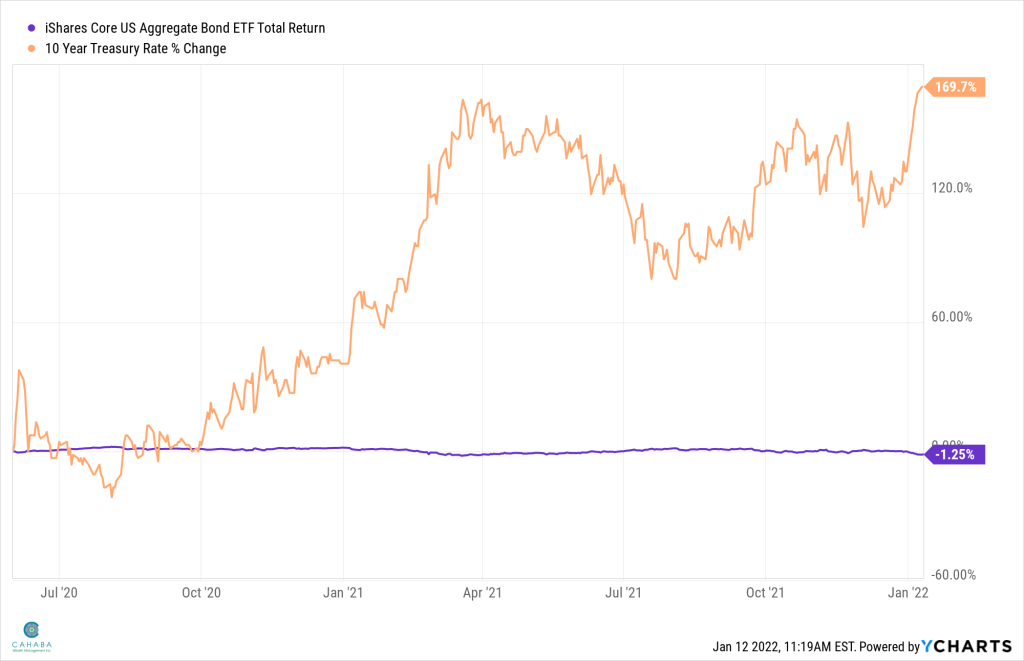

On June 1, 2020, after the realities of the pandemic were fairly clear, the 10-Year yield had dropped to .66%. Since that time, the move in yield to 1.8% amounts to a rate of change of 169%, and yet, during that same time, the core bond holding in our non-taxable accounts (iShares US Core Aggregate Bond – symbol AGG) is down only 1.25%.

While not perfect, a significant move in interest rates has not “destroyed” value in client portfolios. What it has done is allowed our clients to maintain dry powder for rebalancing, cash withdrawals, and holding a simple lower-risk investment.

In a complimentary fashion, this also allows our clients to maintain their equity positions, and take advantage of the significant gains the market has provided during that 18 month period, while withstanding the volatility with which those gains naturally come. We always say that bonds are an emotional stabilizer, and allow you to take risk in the equity part of your portfolio.

Bond Portfolio Duration

The primary driver behind minimizing losses, even in a rising rate environment, will be keeping the duration of the bond portfolio under control. The longer the duration (a combination of maturity and potential calls and pre-refunding), the more sensitive a bond portfolio is to interest rate changes. A longer bond portfolio duration will lead to larger drops when rates rise (and conversely increases when rates fall), so we are very careful to manage duration risk in our client portfolios.

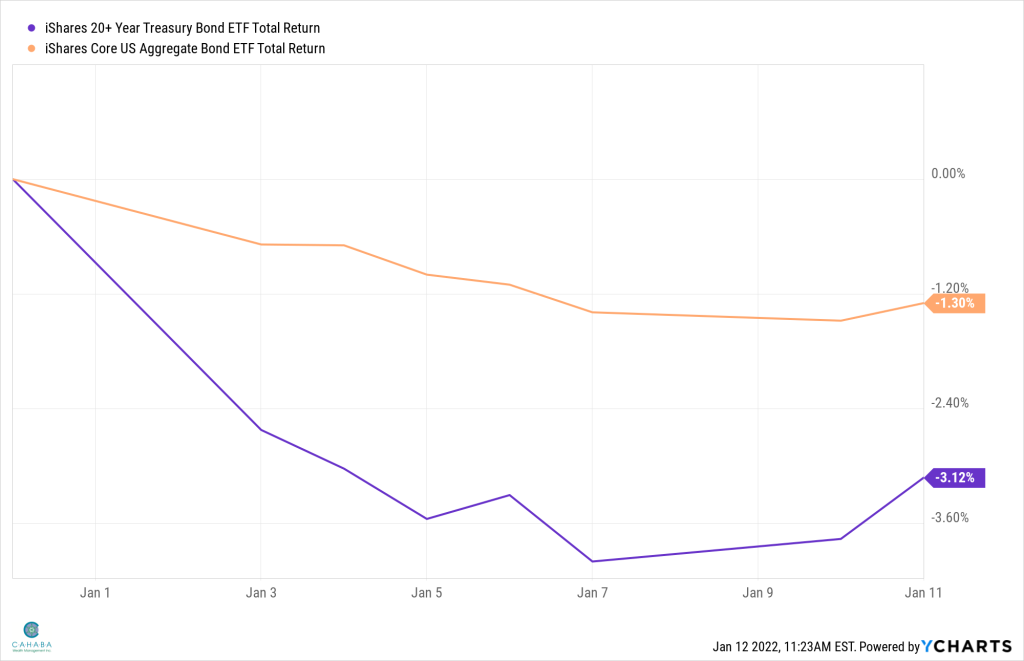

For anyone with an individual bond ladder, rate moves won’t impact returns, but for those in funds/ETFs, they will. Below is a good chart that shows the impact of this recent rate move on longer bond ETFs, and our core ETF (AGG).

The iShares 20- Year Treasury Bond ETF (symbol TLT), with a duration of 19.26 (per www.morningstar.com), has fallen 3.12% so far this year, compared with AGG (duration of 6.64) which has fallen 1.30%. These holdings pay their interest (in the form of a dividend) monthly, so these returns will be improved by that yield (1.88% yield on TLT, 1.61% on AGG – data again per Morningstar) when that dividend pays.

Portfolio Construction: Overall View

Our overall view on portfolio construction is to understand that the market will continuously throw us curveballs, and thus, we need to remain flexible. Bonds will allow for that flexibility, no matter the rate environment. We will use our clients’ tolerance for risk, the time horizon understood through our detailed view of cash flow, and create an allocation built to achieve your goals.

We are thankful for the opportunity to serve you as a client and look forward to continuing to be a resource for you and your family. Please let us know if you have questions or would like to discuss in greater detail.

Brian O’Neill, CFP®, is president and a financial advisor in the Atlanta office of Cahaba Wealth Management, www.cahabawealth.com.

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.